E-Sign’s automatic payment capture feature allows users to request and capture payments in seconds, following document completion.

E-Sign allows you to integrate your preferred payment gateway with our platform, creating a faster and more efficient way to complete your business transactions.

Use our instant payment processing to securely capture payments from customers and allow them to e-sign documents, all within one transaction.

E-Sign can be integrated with a range of trusted payment providers, such as Apple Pay, Stripe, and PayPal, giving extra assurance to customers that their data is secure when making a payment.

Simplified document management.

Our payment capture streamlines document management by combining two transactions into one. Once your payment gateway has been connected to the E-Sign platform, our Payment Tags option allows you to add a payment request to a document quickly and easily.

E-Sign accepts both Apple and Android Pay as well as major credit and debit cards from your customers. Depending on the payment gateway you use, approved payment methods can vary. For example:

Avoid chasing payments from clients.

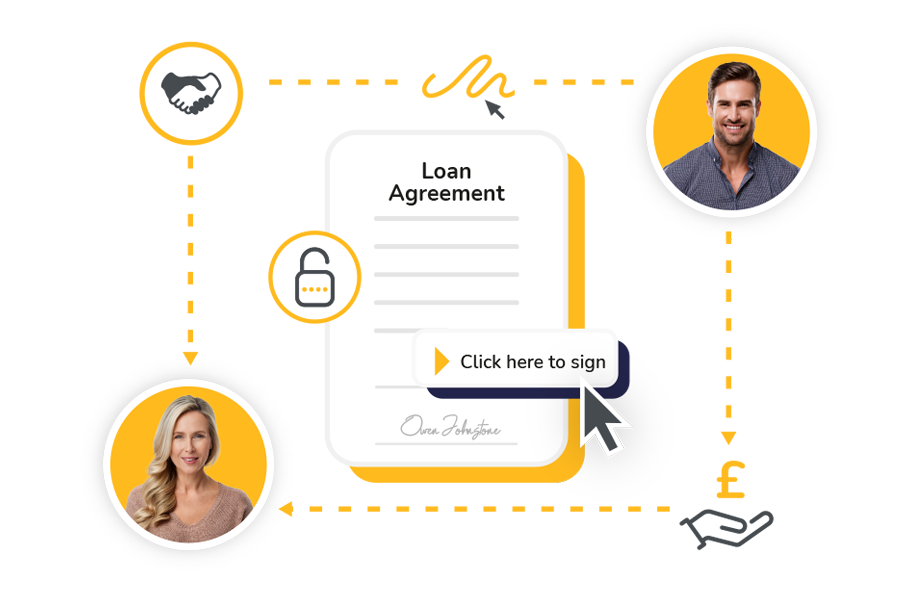

Transactions can be completed quickly and securely with our payment capture. Signatures and payments can be collected on various types of contracts and agreements, including:

Businesses can also benefit from improved accountancy and financial modelling due to being able to collect payments directly into their bank accounts. Having data accuracy is essential to future growth for your organisation.

Create bespoke workflows to suit your business with a range of application integrations.

E-Sign provides real-time audit trails of payment capture and completed documents.

Our payment capture allows payments to be made at the same time as signing documents, so you don't have to chase payments.

The ability to complete documents and payments in one transaction streamlines the customer journey and improves their experience with your business.

Payments can be directly transferred into your bank account for more efficient accountancy and financial modelling.

Our payment capture is quick and easy to set up, simply link your payment gateway to your E-Sign account to start collecting payments.

E-Sign makes security a priority with a robust system in place and all data being encrypted, ensuring your customers feel assured when making payments.

Discover eSignature solutions and use cases in your industry.

Improve compliance, speed up contract management, and simplify document processes with a powerful digital document management solution.

Learn More

eSign delivers comprehensive digital document solutions tailored for healthcare organisations, enhancing efficiency, accelerating processes, and cutting costs.

Learn More

Streamline financial agreements, speed up transactions, and eliminate manual tasks using secure electronic signatures and digital workflows.

Learn More

eSign supports educational organisations with digital tools for enrolment, HR, financial aid, and other documentation needs.

Learn More

Simplify accountancy and tax workflows with digital tools, including e-signatures for tax documents, bookkeeping, with seamless software integrations.

Learn More

eSign powers digital transformation across various industries, providing tailored solutions for organisations and individuals.

Learn More

The healthcare industry clearly recognised the need to adopt a digital approach to prescription processing, giving operational advantages, regulatory compliance and improvements to patient safety.

There has been significant time and cost savings on the sign-up process for new tenants as there is no longer a requirement for officers or tenants to travel to meet in a location to sign the agreement.

We have seen significant improvements in our pharmacy service efficiency since implementing E-Sign. The platform is user-friendly and has allowed our team to securely and reliably provide prescriptions for crucial patient medication.

eSign templates simplify document signing for your business, saving time and resources. Easily integrate electronic signatures into your workflow, whether it’s contracts, agreements, or other legal documents.

Payment processing involves the secure collection of payments from customers using our instant payment processing solution. This feature allows your clients to conveniently sign documents electronically and complete payments in one simple transaction.

Yes, our payment processing service can streamline collecting payments, which means you can spend less time managing transactions, and also increase operational efficiency.

Efficient payment processing can provide better financial stability through receiving funds quicker, which leads to improvements in cash flow. Also, the automation of payment processing means the manual labour requirements are reduced, saving costs in that area and boosting productivity.

By providing time-saving, hassle-free transactions for customers, their experience and satisfaction with your business is enhanced. This can result in more business through positive word of mouth and long-lasting customer relationships.

E-Sign’s payment processing solutions can scale with your business as it grows, handling higher transaction volumes and expanding payment options to meet the evolving needs of your customers.

Payment processing is essential for managing debit and credit card transactions. Serving as a midpoint between merchants and financial institutions, the payment processor authorises transactions and facilitates the timely transfer of funds, ensuring merchants receive their payments quickly and efficiently. By managing the transaction process, payment processors provide seamless and secure payment experiences for both merchants and customers.

Yes, automating your payment processing with our payment capture removes the risk of mistakes in data entry, calculations, and more, which in turn means your financial records will be more accurate.

Yes, E-Sign is committed to protecting user data and ensuring all transactions in the platform are completed with the highest security standards. Our strict security systems, policies, and procedures keep sensitive payment details safe and reduce the risk of fraud.

Payment processing systems offer detailed transaction records and reports, streamlining the reconciliation process and making it easier to track and manage financial data.

There are several benefits to using our payment processing feature such as time savings, better security, reduced human error, enhanced customer satisfaction, and more.

This Adobe site doesn't match your location

Based on your location, we think you may prefer the website, where you'll get regional content, offerings, and pricing.